Work and Life Balance

Your Disability Coverage

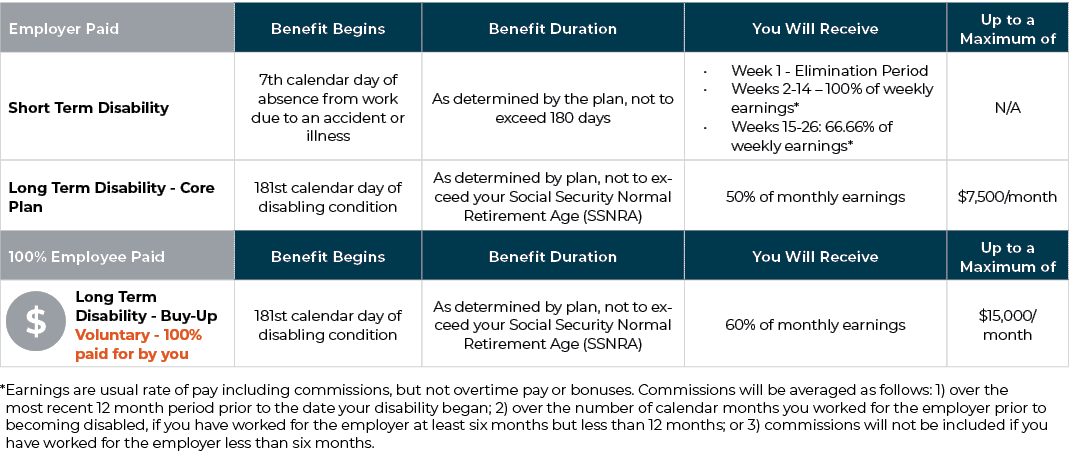

You may not imagine yourself unable to work due to injury or illness, but it’s best to be prepared. Cision has short term (STD) and long term disability (LTD) programs to provide income if you are disabled and cannot work. Both plans are administered through Prudential.

Prudential manages and approves all disability leaves for Cision employees.

Short Term Disability Coverage (Up to 180 Days)

If you are unable to work because of illness or injury you may receive STD benefits after being disabled for seven calendar days. Prudential must approve your claim before you start receiving STD benefits. You may continue to receive STD benefits for up to 180 days from when the illness or injury occurred. STD coverage is provided to you by Cision. There is no cost to participate. View the 2024 Leave of Absence Guide to learn more.

Core Long Term Disability Coverage (181 Days or More)

If you have LTD coverage and your illness or injury continues longer than 180 days you may receive LTD benefits. Prudential must approve your claim before you start receiving LTD benefits. Core LTD coverage is provided to you by Cision. View the 2024 Leave of Absence Guide to learn more.

Buy-Up Long Term Disability (181 Days or More)

You have the opportunity to purchase additional Long Term Disability coverage through Prudential, paid for 100% by you. Think of the buy-up LTD plan as the “Cadillac” plan. You will pay extra premium to increase the monthly LTD benefit that you would receive in the event of your disability. The total benefit that you would receive if you elected the buy-up plan would be 60% of your pre-disability earnings, up to a maximum of $15,000 per month. View the 2024 Leave of Absence Guide to learn more.

Resources

File a Claim

To file a claim with Prudential, you can call 1.877.367.7781 or log in to prudential.com/mybenefits and click Claims & Absences, File a claim/report an absence.

Questions?