Your Mental Health

Collaboration is paramount; we act with teamwork in mind. Together, we are simply better.

We care, support, and help each other grow; and celebrate our successes and have fun along the way.

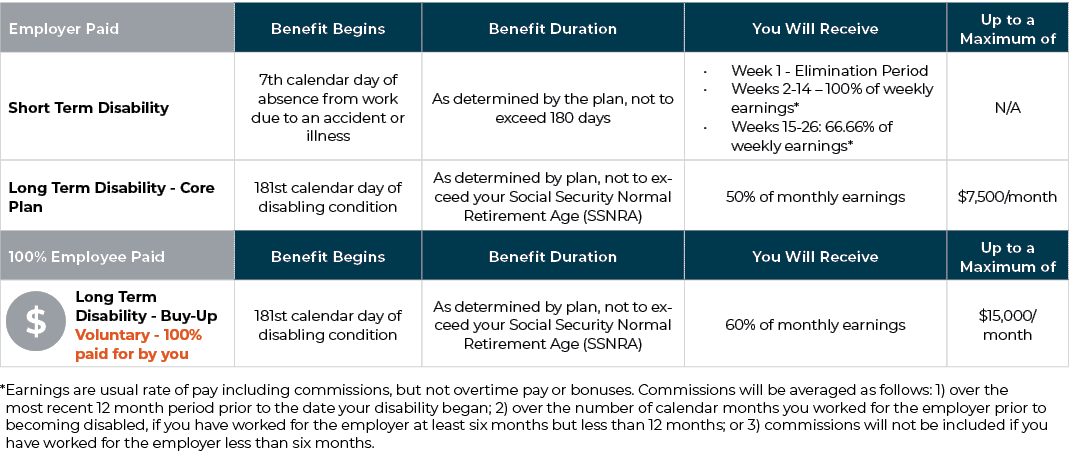

Your Disability Coverage

You may not imagine yourself unable to work due to injury or illness, but it’s best to be prepared. Cision has short term (STD) and long term disability (LTD) programs to provide income if you are disabled and cannot work. Both plans are administered through Lincoln Financial Group.

Lincoln Financial Group manages and approves all disability leaves for Cision employees.